pay indiana fuel tax online

It also helps to maintain your trip sheet for IFTA Audit. Online application to prepare and file Quarterly IFTA return for Indiana State.

Fuel Permits Ifta Permit Temporary Ifta Permits

Convenience Fees apply when using a credit card.

. Fuel tax decals will be delivered 7-10 business days after they are ordered unless overnight shipping has been requested at the carriers expense. Gasoline Use Tax GUT. INTAX only remains available to file and pay special tax obligations until July 8 2022.

Locate your states website. The online Indiana Fuel Tax System offers motor carriers the ability to manage all of their MCFTIFTA transactions with Motor Carrier Services online. Send in a payment by the due date with a check or money order.

Transporter Tax TRP. Search IFTA and the name of your state to find the correct website. The price of all motor fuel sold in Indiana also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration.

Have your account number available. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax accounts in one convenient location 247. INTAX only remains available to file and pay the following obligations until July 8 2022.

430 pm EST. Residential meters are read on approximately the 27th of each month and bills are due on the 20th of the month. Details on how to pay or submit a protest are.

If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. Search by address Search by parcel number. Find Indiana tax forms.

October 27 2020 Uncategorized by Leave a Comment on pay fuel taxes online. 124 Main rather than 124 Main Street or Doe rather than John Doe. The special fuel license tax rate is 053 per special fuel gallon for the same time period.

Click the button below to view details on three IN fuel tax reports. As of September 2021. Claim a gambling loss on my Indiana return.

The Indiana gasoline license tax rate is 032 per gallon effective July 1 2021 through June 30 2022. If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am. The application allows you to process and pay your quarterly tax returns and.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. You will need an IFTA. These tax types will transition to INTIME DORs e-services portal at intimedoringov where customers will be able to file make payments and manage their tax accounts beginning July 18 2022.

Take the renters deduction. Motor Fuel - MFT. Gasoline Use Tax - GUT.

Search for your property. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247. If you want to pay your IFTA taxes online you typically must open an account with the taxation or revenue agency in the state where your business is based.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage tax accounts in one convenient location at intimedoringov. INtax only remains available to file and pay the following tax obligations until July 8 2022. Fuel producers and vendors in Indiana have to pay fuel excise taxes and are responsible for filing various fuel tax reports to the Indiana government.

When you receive a tax bill you have several options. Federal excise tax rates on various motor fuel products are as follows. 218-2017 requires the department to publish the new rates effective July 1 2021 for the gasoline license tax IC 6-6-11-201 and special fuel license tax IC 6-6-25-28 on the departments Internet website no later than June 1 2021For the period July 1 2021 to June 30 2022 the following rates shall be in effect.

For more information on DORs tax system modernization efforts visit Project NextDOR at doringovproject-nextdor. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. This is where youll begin the INtax registration process.

The Indiana Department of Revenue Motor Carrier Services Division Fuel Tax System software provides a browser-based means of taxation and motor carrier registration with internal access for support functions auditing and decal shipments and external access for motor carriers and service bureaus to. Online payment by credit card or check through our Online Portal. If you want to pay your IFTA taxes online you typically must open an account with the taxation or revenue agency in the state where your business is based.

For best search results enter a partial street name and partial owner name ie. INtax supports the following tax types. Welcome to the Fuel Tax System Online Help.

Contact the Indiana Department of Revenue DOR for further explanation if you do. Indiana per capita excise tax. Departmental Notice 43 Indiana Department of Revenue May 2021 403-615 Other References.

Pay my tax bill in installments. Have more time to file my taxes and I think I will owe the Department. Under Indiana Code 9-20-18-145b.

Have 60 days from the date of the proposed assessment letter to pay in full or protest the assessment. The system was designed to provide motor carriers with a single source for all their fuel tax reporting in Indiana. Know when I will receive my tax refund.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. You will need to provide the following information when applying for the IFTA license. Special Fuel - SFT.

Increase in Gasoline License Tax and Special Fuel License Tax. Phone payment by credit or debit card - Call 855-472-9862. Filing and Paying Taxes Indianas free online tool to manage business tax.

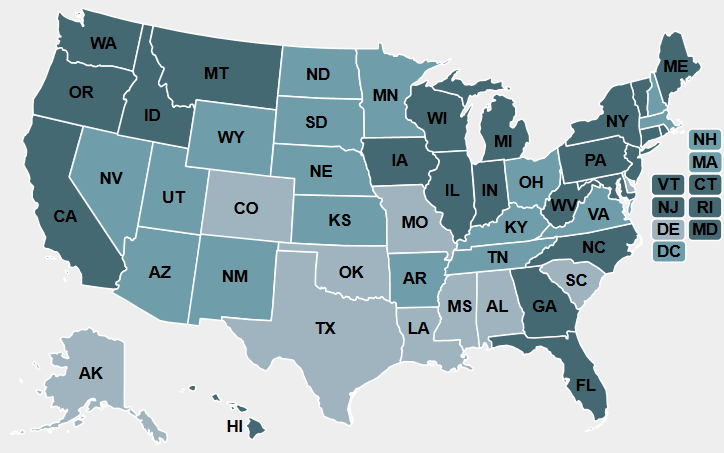

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

U S Gasoline Motor Fuel Taxes In January 2022 Statista

Gasoline Prices Which States Pay The Most And Least Taxes New Cars Buying New Car Clip Art

Fuel Permits Ifta Permit Temporary Ifta Permits

Indiana Ifta Fuel Tax Requirements

Fuel Permits Ifta Permit Temporary Ifta Permits

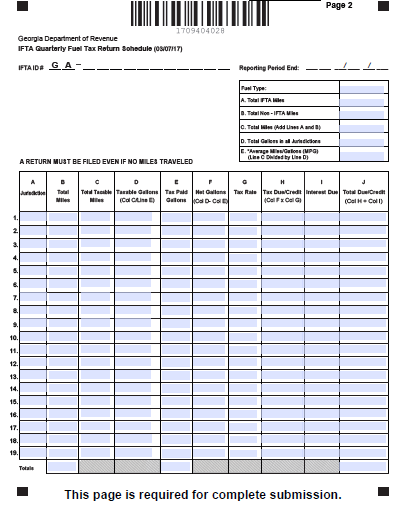

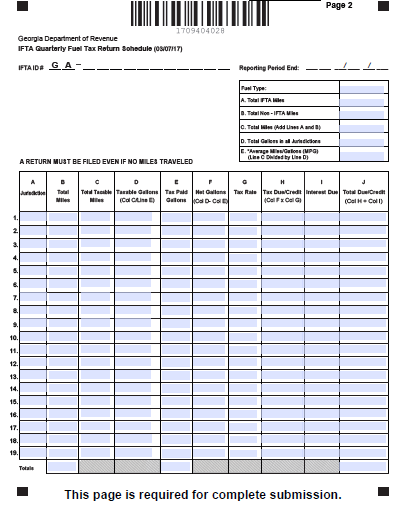

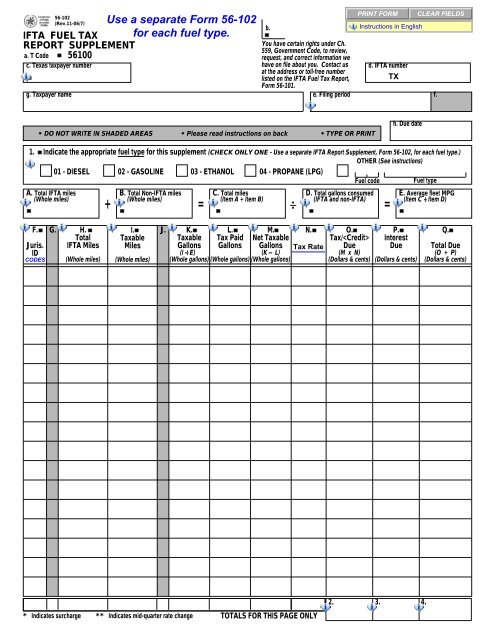

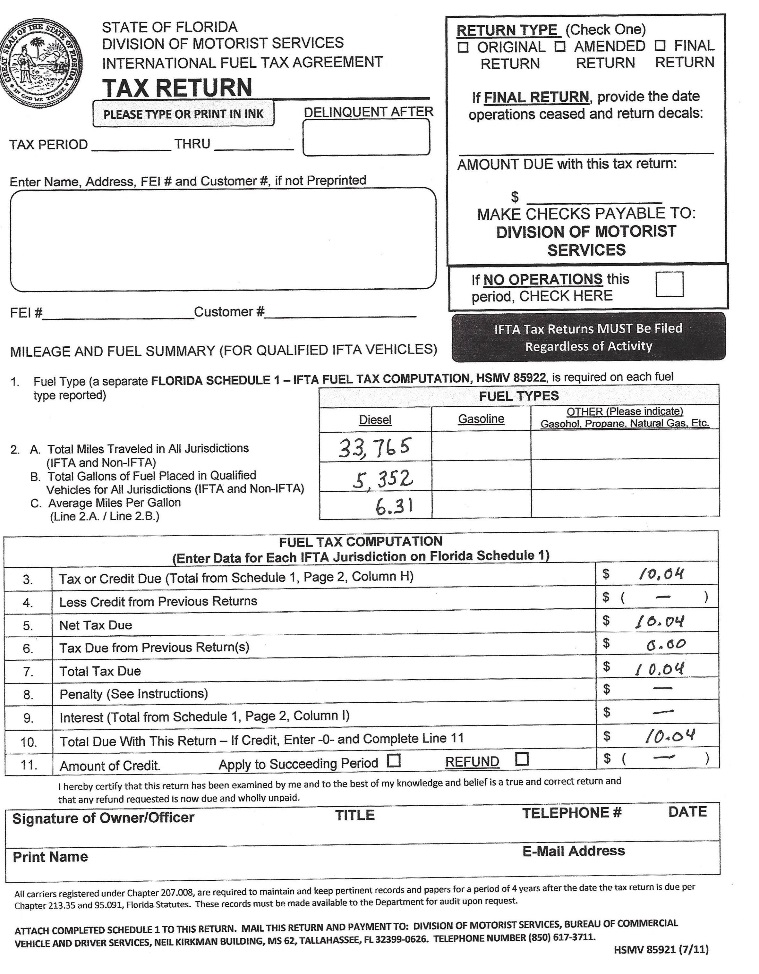

Ifta Fuel Tax Report Supplement

Fuel Permits Ifta Permit Temporary Ifta Permits

How To File And Pay Your Ifta Fuel Tax Youtube

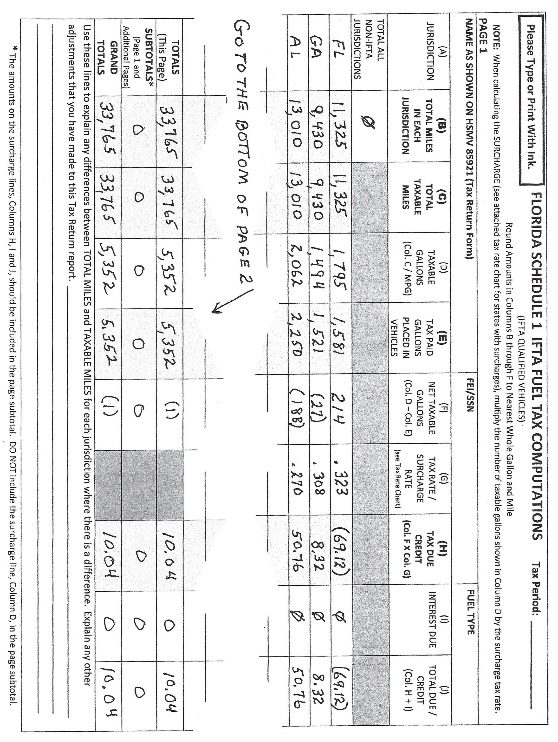

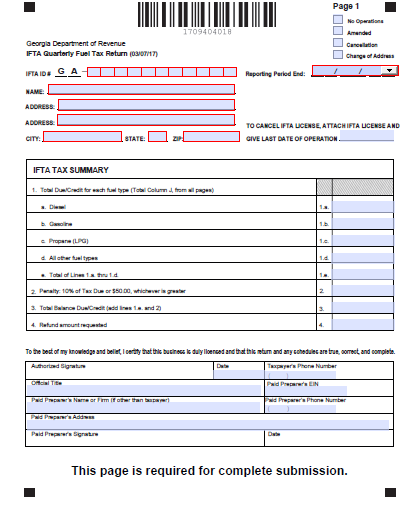

Ifta Fuel Tax By State File State Fuel Tax Ifta Preparation And Filing

Fuel Permits Ifta Permit Temporary Ifta Permits

3 Ways To Pay Ifta Taxes Online Wikihow

Ifta Inc International Fuel Tax Association

Fuel Permits Ifta Permit Temporary Ifta Permits

Ifta Fuel Tax Report Requirements Blog Truckingoffice

Ifta Reporting Software Ifta Filing Online Quarterly Fuel Tax Reporting

Everything You Need To Know About Ifta

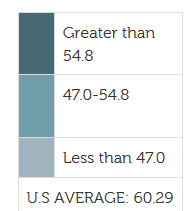

How Long Has It Been Since Your State Raised Its Gas Tax Itep